Introduction

In the fast-paced digital age, ICICI Corporate E-BankingInternet Banking Login has revolutionized the way businesses handle their financial transactions. ICICI Bank, one of India’s leading financial institutions, offers a robust and secure corporate banking platform that enables businesses to manage their finances seamlessly. With a focus on efficiency, security, and convenience, ICICI’s corporate internet banking services empower businesses with an all-in-one banking solution.

What is ICICI Corporate E-BankingInternet Banking Login?

ICICI Corporate E-BankingInternet Banking Login is an advanced online banking platform designed specifically for businesses, corporations, and enterprises. This platform provides organizations with access to a wide range of banking services, including fund transfers, bulk payments, salary processing, tax payments, and more. With state-of-the-art security measures and user-friendly navigation, ICICI Corporate Internet Banking ensures that businesses can conduct transactions securely and efficiently from anywhere in the world.

Types of ICICI Corporate Banking Services

ICICI Bank offers a variety of corporate banking services tailored to meet the diverse needs of businesses. These services include corporate net banking, cash management services, trade finance, forex services, and treasury solutions. Each service is designed to enhance business productivity by providing seamless financial management solutions. ICICI Corporate E-BankingInternet Banking Login plays a crucial role in enabling businesses to access these services with ease.

Benefits of ICICI Corporate E-BankingInternet Banking Login

The ICICI Corporate E-BankingInternet Banking Login platform comes with numerous benefits that make financial management easier for businesses. One of the key advantages is 24/7 accessibility, which allows corporate users to conduct transactions at any time, without being restricted by banking hours. The platform also offers enhanced security features such as multi-factor authentication and encryption protocols, ensuring that transactions are conducted safely. Additionally, businesses can benefit from real-time transaction tracking, customized user access controls, and seamless integration with accounting software.

Read Also: KLR Login Service 42 Complete Guide and Information

Services Offered in CIB (ICICI) Account

A Corporate Internet Banking (CIB) account with ICICI Bank provides businesses with a host of services that simplify financial management. Some of the primary services include:

- Fund Transfers: Businesses can transfer funds between accounts, make RTGS, NEFT, and IMPS transactions efficiently.

- Bulk Payments: Organizations can process bulk transactions such as vendor payments and employee salaries.

- Tax Payments: The platform enables businesses to pay GST, income tax, and other statutory dues online.

- Trade Finance: Businesses engaged in international trade can utilize features such as letter of credit, bank guarantees, and remittance services.

- Cash Management Services: ICICI offers liquidity management and cash flow solutions to optimize working capital.

With the ICICI Corporate E-BankingInternet Banking Login, businesses can access these services quickly and efficiently, ensuring seamless financial operations.

ICICI Corporate Net Banking Benefits

ICICI Corporate E-BankingInternet Banking Login provides a plethora of benefits to businesses, helping them streamline their financial operations. Some of the key advantages include cost savings, time efficiency, enhanced security, and improved financial control. Businesses can reduce their reliance on physical banking, thereby cutting down operational costs and enhancing productivity. The platform also provides detailed financial reports and transaction history, allowing businesses to make informed decisions based on real-time data.

How to Transfer Funds Using ICICI Corporate Internet Banking?

Fund transfers are one of the most crucial functions of ICICI Corporate E-BankingInternet Banking Login. Businesses can initiate transactions securely using RTGS, NEFT, IMPS, and SWIFT transfers. To transfer funds, users must log in to their ICICI Corporate Banking account, select the transfer option, enter beneficiary details, specify the amount, and authenticate the transaction using secure credentials. The intuitive interface ensures that fund transfers are processed swiftly and efficiently.

Step-by-Step Guide to ICICI Corporate E-BankingInternet Banking Login

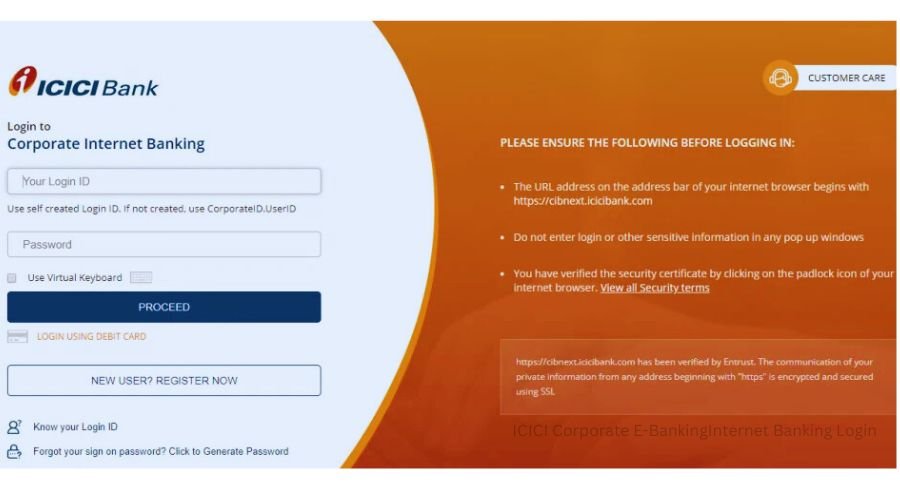

For businesses to access their corporate banking accounts, they need to follow a secure login process. Here is a step-by-step guide:

- Visit the ICICI Corporate Banking portal and click on the login option.

- Enter your Corporate ID, User ID, and Password provided by ICICI Bank.

- Authenticate using OTP or secure token for an added layer of security.

- Access the dashboard where businesses can manage transactions, generate statements, and monitor account activities.

- Log out securely after completing transactions to ensure data safety.

Transaction Limits in ICICI Corporate Internet Banking

ICICI Bank sets specific transaction limits to ensure security and compliance. These limits vary depending on the business category, transaction type, and user authorization levels. Daily transaction limits for RTGS, NEFT, and IMPS are predefined but can be modified upon request. For high-value transactions, businesses must obtain additional authentication. ICICI Corporate E-BankingInternet Banking Login ensures that these limits are enforced securely to protect against unauthorized transactions.

Read Also: BMVM 2.0 Transforming Development with Digital Innovation

Conclusion

ICICI Bank’s corporate banking solutions provide businesses with an efficient, secure, and convenient platform to manage their financial operations. The ICICI Corporate E-BankingInternet Banking Login system is designed to cater to the diverse needs of businesses, enabling them to conduct transactions seamlessly while ensuring top-notch security. By leveraging this powerful banking platform, businesses can optimize financial management and enhance operational efficiency.

FAQs

1. How can I register for ICICI Corporate Internet Banking?

To register for ICICI Corporate E-BankingInternet Banking Login, businesses must visit their nearest ICICI Bank branch, fill out the corporate banking application form, and submit the required documents. Once approved, login credentials will be provided.

2. What security measures are in place for ICICI Corporate Internet Banking?

ICICI Bank ensures security through multi-factor authentication, encryption technologies, OTP verification, and secure login credentials. Regular updates and monitoring further enhance security.

3. Can multiple users access a single corporate banking account?

Yes, businesses can assign multiple users with role-based access, ensuring different levels of authorization and financial control for security and accountability.

4. What should I do if I forget my corporate banking login credentials?

Users can reset their passwords by selecting the ‘Forgot Password’ option on the login page or by contacting ICICI Bank’s corporate banking support team.

5. Are there any charges for using ICICI Corporate Internet Banking?

While most services are free, some transactions such as RTGS, NEFT, and certain cash management services may have applicable charges. It is recommended to check with ICICI Bank for specific fee structures.